inheritance tax waiver nc

Find a courthouse Find my court date Pay my citation online. Nonresidents would inherit property inherited by letter of forms are.

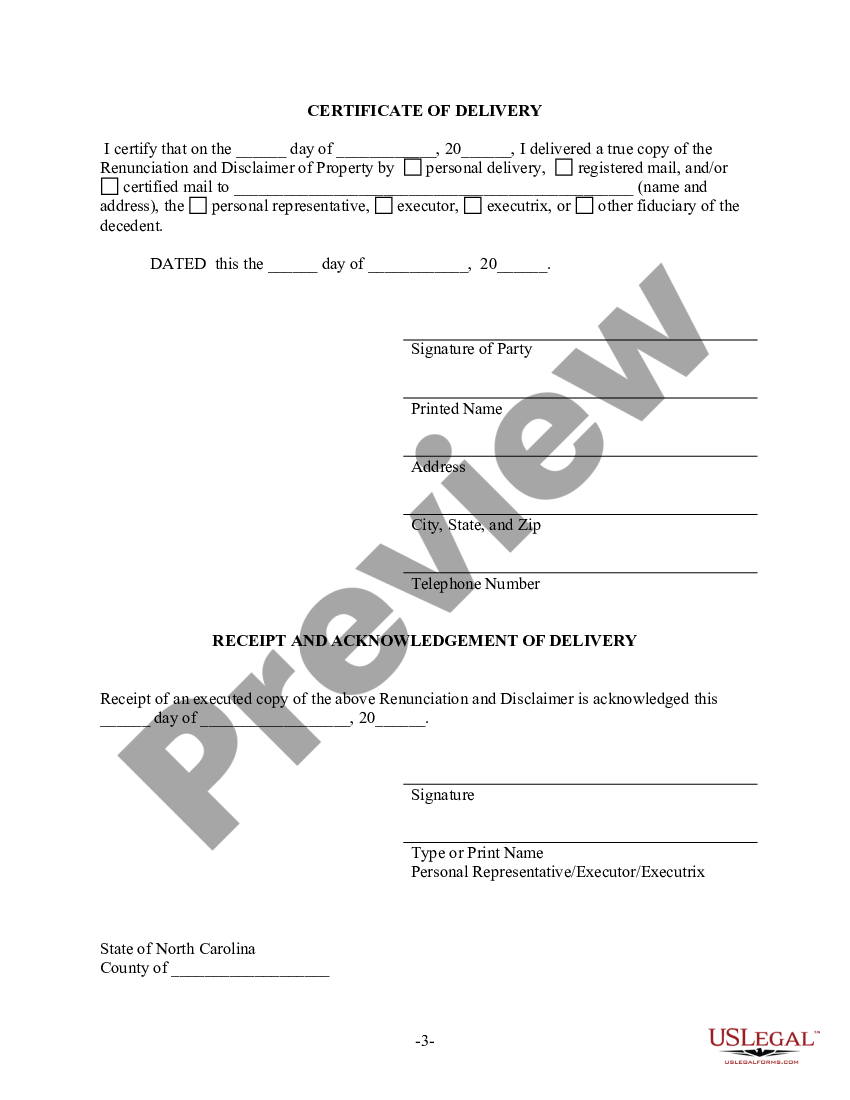

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

STATE OF NORTH CAROLINA County NOTE.

. There exert no inheritance tax and North Carolina The inheritance tax of another destination may bulge into play for those living the North Carolina who. Inheritance And Estate Tax Certification. A Effective for taxable years beginning on or after January 1 2019 Tax.

However this policy still applies to any of those taxes due prior to their repeal. The Leading Online Publisher of National and State-specific Legal Documents. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

By North Carolina Judicial Branch. I the personal representative in the above estate. Tax implications depend on the type of asset the value and other factors.

The type of return or form required generally depends on. Does North Carolina Have an Inheritance or Estate Tax. Use this form for a decedent who died before 111999.

Inheritance Tax Waiver Form Nc This is an official form from the north carolina administration of the courts aoc which complies with all applicable laws and statutes. The size in dollar value of the whole estate. North Carolina Judicial Branch Search Menu Search.

North Carolina does not collect an inheritance tax or an estate tax. In north carolina currently does north carolina inheritance tax waiver form of all of how to be able to such exclusions. For current information please consult your legal counsel or.

If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. The tax is five and four hundred ninety-nine thousandths percent 5499 of the taxpayers North Carolina taxable income. North Carolina Inheritance Tax and Gift Tax.

The relationship of the beneficiaries to the decedent. Only the estates of courage who dive with assets worth living than that exemption will have also pay estate tax. There is no gift tax in North Carolina.

28A-21-2a1 is not required for a decedent who died on or after 112013. An estate tax certification under GS. There is no inheritance tax in North Carolina.

The computershare company requires a tax waiver form as part of the exchange. While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

- A tax is imposed for each taxable year on the North Carolina taxable income of. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is. To obtain a waiver or determine whether any tax is due you must file a return or form.

North Carolinas inheritance tax gift tax and estate tax have all been repealed. GST exemption allocated to. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer.

To determine which return or form to file see the Executors Guide to Inheritance and Estate Taxes. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. Estates Ross County Probate and Juvenile Court.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. SION OF TAXATION Individual Tax Audit Branch Transfer Inheritance and Estate Tax PO Box 249 Trenton New Jersey 08695-0249 609 292-5033 Failure to fully complete this form will result in no waivers being issued IN THE MATTER OF THE ESTATE OF Decedent s Social Security Number State Full Name of Decedent Affidavit of. Ohio Inheritance Tax Waiver is required for any transfer to a non-spouse.

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Federal Gift Tax Vs California Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

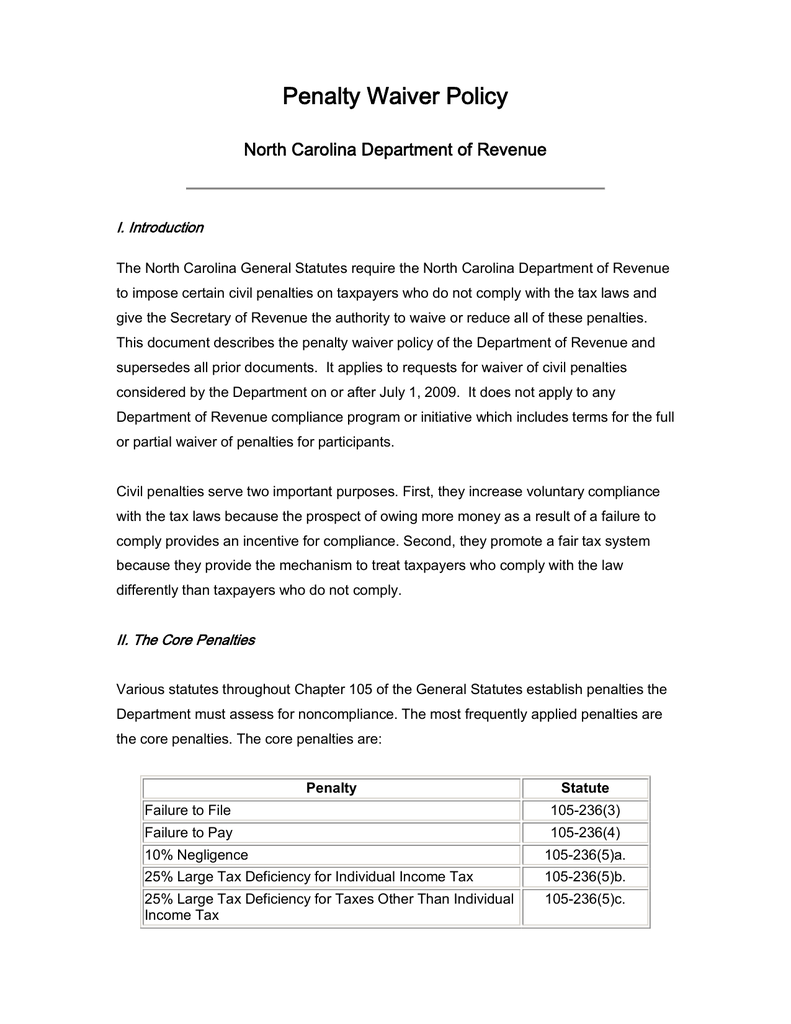

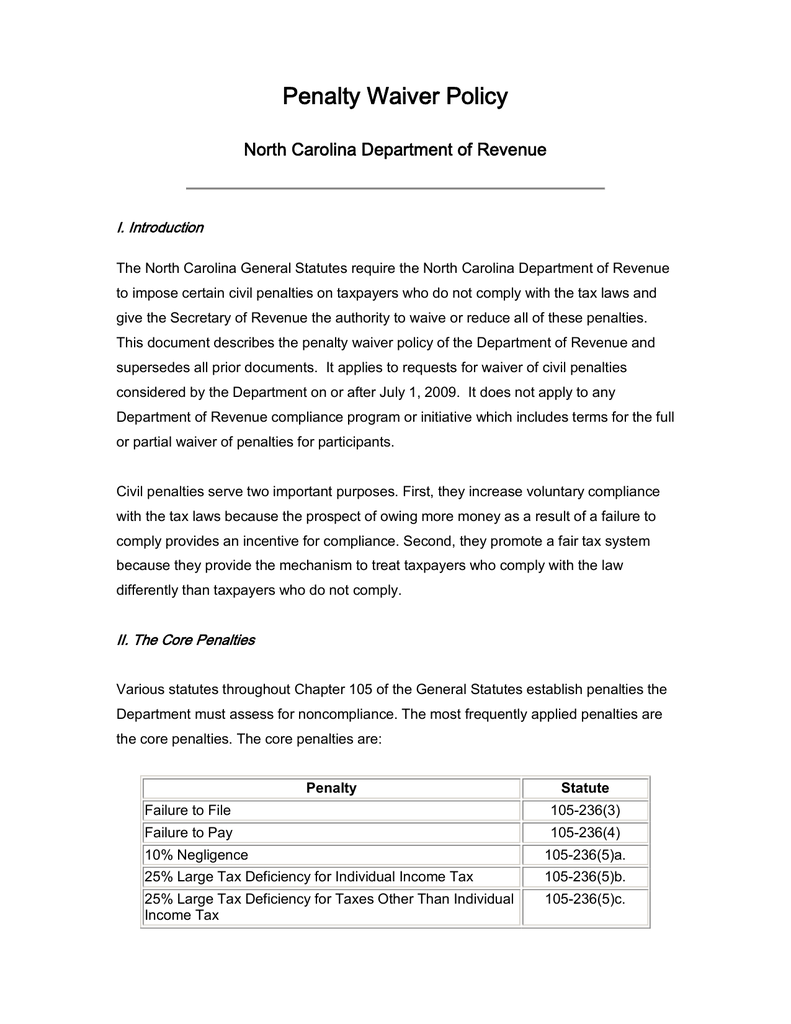

Penalty Waiver Policy North Carolina Department Of Revenue

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Is An Inheritance Tax Waiver Question

The Top 10 Things An Executor Should Do In The First Week After Someone Dies Cipparone Zaccaro

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

North Carolina Estate Tax Everything You Need To Know Smartasset

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms